In this post, I will share step by step how I create my budget and track my expenditure.

Budgeting is one of my pillars of financial independence that I discussed here.

How you approach it is personalized so I’m sharing mine for you to maybe get a few ideas that you can borrow from.

1. List out all your income and expenditure

List out everything that you make money from and spend money on and name it. I know this takes like 10 minutes tops because I’ve done it with friends before.

You will come up with quite the list . Don’t be scared.

Include even costs that don’t recur regularly but are things you know you would spend on again.

2. Divide these costs into categories

This is useful because if I was to cut down , I can know where to do that from and I like to track these areas separately.

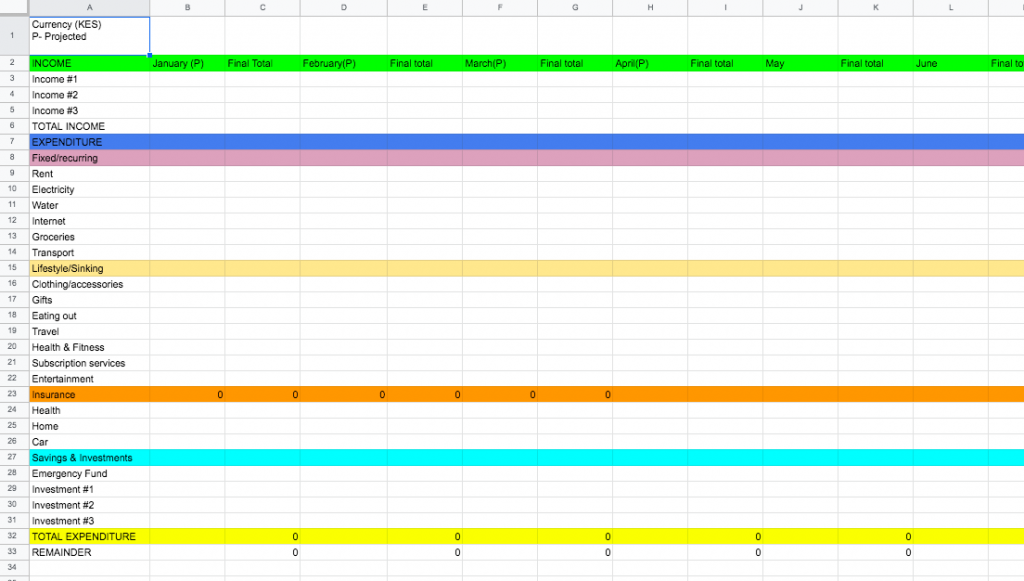

From the list in step 1, these are my 5 categories:

- Income

- Fixed / recurring expenses

- Lifestyle & sinking funds. I’ve talked about sinking funds in detail here.

- Insurance ( health , home , car)

- Savings & investments

3. Create a yearly spending plan / budget plan

I got this idea from a highly informative YouTube channel called One Big Happy Life . They do have a free budgeting template that I tweaked to make mine.

I know you’re going to say, how can I predict what & how much I’ll spend in a year ?

The idea is to work with estimates. In each month , you have a projected column and a final column which you fill at the end of the month.

There is something about having a bird’s eye view of all the money you will earn, spend and invest in the year. Looking at your finances this way gives you perspective on how much you can do with your income.

This stage is where my excel spreadsheet comes in. I simply transfer the 5 categories in step 2 onto the spreadsheet and list out the categories in step 1 under each.

4. Choose a daily expense tracker

This could be on an app, a book, journal or even the same spreadsheet.

I use Monefy which I’ve mentioned a thousand times at this point. I got the pro version for a one time fee of $2/ 200 bob which allows me to have unlimited categories.

I simply created the categories that are on my spreadsheet in this app. I love this because as soon as I pay for anything, I can log that expense immediately before I forget.

At the end of the month , I can transfer all daily expenses onto my spreadsheet and it’s so easy because the categories match.

5.Have a system for review

It is not enough to simply track my expenses. I also take some time to reflect through how the month went financially with a more holistic view.

I know some people do weekly , monthly , quarterly & yearly check ins. Whatever floats your boat honestly as long as you create the system and stick to it.You can create a set of questions to ask yourself at every review.

Did I hit my saving targets ? Am I comfortable with how much I’m spending? Do I need to increase my budget for a certain category?

These kinds of questions are what move you from simply observing your money habits to taking charge of them.

I hope this post was helpful. Let me know how you track your finances in the comments down below.

“Always remember that your hair is your crown and your body is a temple; embrace it , love it and take care of it.”