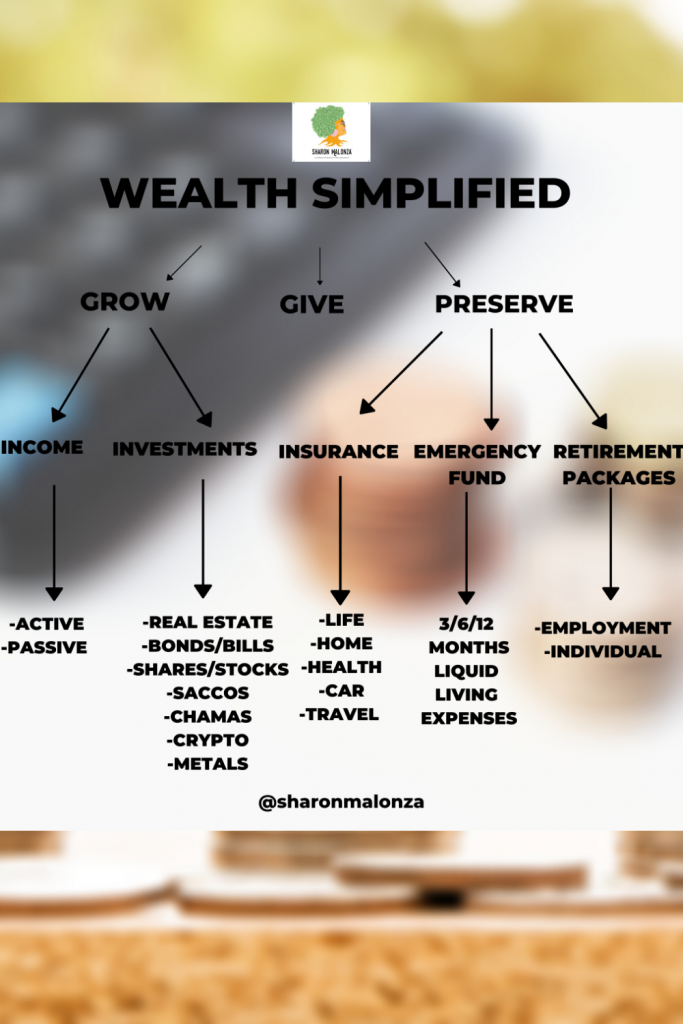

Today, I am sharing what I consider the seven pillars of my financial independence. I look at finances in 2 ways : creating wealth and preserving it. Each of these pillars does one or both of these things. They may not in order of priority per se because I feel that all 7 of them are equally important .The idea is that a combination of these 7 spheres not only guarantees personal financial independence but can create intergenerational wealth . I have talked about steps I have already begun taking towards financial freedom before.

Table of Contents

Income/Revenue Streams

Your revenue streams can be from a job , your own business , a sponsor/guardian/parent or from your investments. My ideal setup is to have more passive than active streams of income but reliable income streams nonetheless.

A budget/ spending plan

Everything is included here from your fixed living expenses to your sinking funds for travel , enjoyment , gifts , mutual aid , tithes , and even allocations for consistent investments and debt payoff .

To me , saving is not a separate pillar because I factor it into my budget. Do you separate savings from your budget?

An Emergency fund

An emergency fund is 6-12 months of living expenses in liquid assets . Some examples of these include a money market fund, high interest savings account , flexible fixed deposit account or a short term government treasury bill.

There’s no greater security than knowing that if you lost your source of income today ( business , job, parent/guardian), you can at least get through 6 months as you figure things out.

I’d rather overestimate my monthly expenditure and funnel the extra money into my investments than to underestimate it and be stranded.

A debt payoff plan

This may only apply if you have debts. However, if you don’t have debt, it is good to learn the difference between good and bad debt because debt can be a useful instrument for financial freedom. I believe that managing debt while working on these other pillars is the best approach.

Investments

There are so many investment opportunities out there. Some examples include stocks, real estate, businesses , government securities, SACCOs and investment groups/chamas.

Creating a diversified portfolio that is based on your personal financial goals is the way to go. More often than not, it requires seeking professional advice to create such structures.

Insurance

This is crucial for wealth preservation and is not talked about enough. When it is discussed , it is either about how expensive it is or the scams in the insurance industry that make the public afraid of it.

A good insurance policy protects the wealth you have accumulated. There are so many types including life, health , home , electronics, travel and car insurance, just to name a few.

It’s important to do your research and find insurance plans that will work for your needs.

A Retirement strategy

Thinking about retirement starts with defining what that word means to you. I look at retirement in terms of the age after which working would be a choice not a necessity. Instead of retirement, I like the term work optional. For this to happen, my passive income needs to be enough to sustain my living expenses. By that definition , you can ‘retire’ at any age.

Many people fail to plan for retirement because they live from paycheck to paycheck even when they are getting a significant income. I plan to speak more about retirement in upcoming posts.

These are many things to think about and there are numbers to crunch , goals to set and the approach is in baby steps. I know on a personal level that there will be mistakes on my part and lessons along the way but it will be well worth it. What are your pillars of financial freedom? Let me know down below.

“Always remember that your hair is your crown and your body is a temple; embrace it, love it and take care of it.”